Could you Incorporate Renovation Costs to your Mortgage?

- Whenever you can spend the money for costs: Regardless if you are purchasing good fixer-top or is remodeling a home you might be residing currently, you should pay the month-to-month mortgage money. Look at the income and you can newest property costs and you may calculate if or not there is people action room inside to provide to your a supplementary month-to-month costs. You might like to build slices someplace else in your finances to cover the new renovation loan payments.

- Whether your renovations increase your value of: Although you can’t expect you’ll recoup the complete price of an excellent renovation for individuals who end up selling your house after, it could be convenient to see if your own upgrade could make your residence more vital, whenever therefore, simply how much value it can enhance your residence.

- In the event that renovating is better than swinging: Occasionally, it generates alot more experience to acquire and purchase another house or create property regarding scratch than it will so you can renovate your current possessions. Consider how thorough their home improvements must be so you can help your house be fit you when you progress with a remodelling financing.

If you are buying a home that needs some TLC, it creates experience to find out if you are able to particular of the home loan to pay for the price of home improvements. In some instances, you have the accessibility to doing one. But you need choose the https://paydayloansconnecticut.com/lake-bungee/ right particular financial. Really old-fashioned mortgage brokers cannot be always defense the cost regarding home improvements additionally the residence’s purchase price.

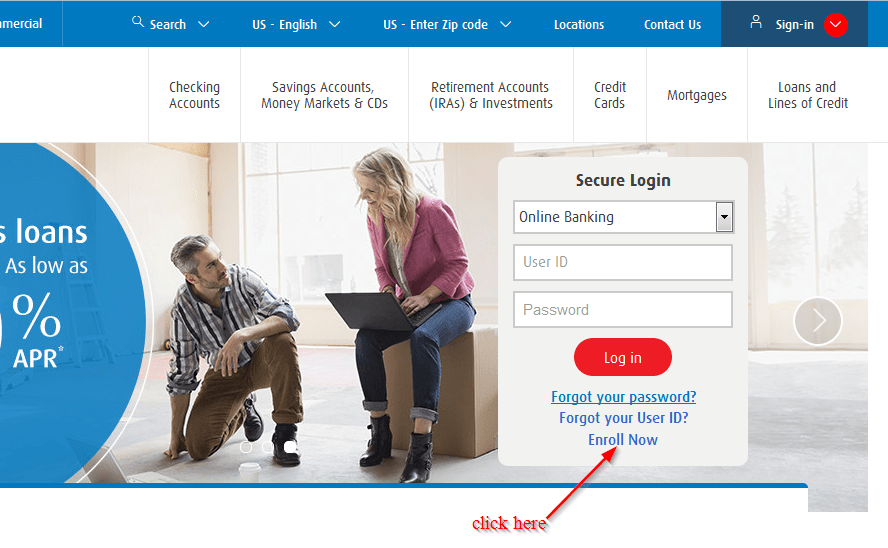

To provide the expense of renovations to your residence mortgage, you really need to see a repair mortgage. After that, after you get the borrowed funds, you acquire sufficient to security new house’s cost plus the cost of the newest renovation.

After you romantic on recovery mortgage, the financial institution will pay owner the fresh house’s selling rate. The remainder borrowed matter goes toward a keen escrow account. Instance, in case the mortgage is $150,100 in addition to domestic costs $100,100, owner will get $100,000, while the leftover $50,one hundred thousand goes to your a merchant account.

The firm undertaking the latest home improvements can get entry to the latest escrow membership and will be capable remove payments from it as performs continues on your panels and you may goals is actually reached. The lender usually find out if efforts are finished before builder becomes paid down.

Exactly what Loan Is perfect for Home improvements?

How you can fund renovations relies on multiple factors, including your most recent homeownership condition, the fresh new recovery project’s cost, plus credit history. Check a few of the loan alternatives.

1. Build Loan

Although someone score a houses mortgage to afford prices to build a home in the floor upwards, you can also find a construction mortgage to afford will set you back of renovating an existing house. Even though the software techniques is comparable, a construction mortgage try a bit different from a mortgage. To obtain the financing, you really need to give proof of money and you will read a card consider. Additionally, you will want to make a deposit towards the loan.

If you choose to score a property loan to pay for household home improvements, you may want while making more substantial down payment than simply your manage to own a timeless home loan. Always, lenders expect consumers to get about 20% off once they financing renovations or brand new build. Together with, truth be told there interest rate toward a casing mortgage was higher than the attention energized for a normal home loan.

After the recovery is complete, a houses financing have a tendency to typically convert to a mortgage. It does do this instantly, or you could need to go from closing techniques again.