FHA Self-Sufficiency Calculator | 3-cuatro equipment qualities

Material

An FHA mortgage is a great option for financing the purchase out-of a multiple-equipment assets. Although not, 3-cuatro equipment attributes should be self-adequate, which means that they have to features a confident cash flow.

Read this article to know about FHA’s care about-sufficiency conditions and choose right up a number of strategies for enhancing the chances that the three to four-tool possessions you need is actually care about-enough. Then, fool around with the FHA Worry about-Sufficiency Calculator to run some recent tests.

What is the self-sufficiency test getting FHA finance?

FHA’s worry about-sufficiency decide to try necessitates that the brand new local rental money from an excellent step 3-cuatro device discusses the brand new property’s costs, such as the housing percentage. That it take to ensures that the property yields enough book getting an audio resource and you makes the mortgage money or any other financial obligation.

To pass the fresh notice-sufficiency sample, the net local rental money for the possessions have to be comparable to or greater than the fresh PITI.

- Disgusting rental earnings is the overall monthly lease generated by the this new equipment, including the that you’ll inhabit, before deducting people expenses.

- Websites rental earnings was 75% of the gross leasing income.

- PITI stands for dominant, interest, taxes, and you may insurance coverage. The fresh new month-to-month casing fee comes with the loan, assets taxation, homeowner’s and you can mortgage insurance policies, and relationship charge.

Imagine if you want to invest in a good three-unit assets, inhabit one device, and you can rent the other two. Another strategies will help you to guess brand new property’s income.

- Are the projected lease for all around three tools to obtain the gross local rental earnings. Tend to be lease to the tool you’ll be able to reside.

- Proliferate brand new terrible local rental income by the 75% to find the online rental income.

- Deduct the PITI on the internet leasing money to determine if the the house have a positive or negative cashflow.

https://paydayloanflorida.net/pine-manor/

To pass the fresh notice-sufficiency sample, the home should have positive cashflow. Put another way, the web based rental income need to equivalent or exceed the newest PITI.

How can loan providers determine FHA’s Internet Worry about-Sufficiency Leasing Earnings?

Lenders make use of the Websites Self-Sufficiency Leasing Income (NSSRI) algorithm to choose if a purchaser have enough money for get and you can manage an effective 3-4 tool property having an enthusiastic FHA home loan.

- Estimate the fresh new month-to-month homes commission, PITI. (Financial Calculator)

- Estimate the fresh month-to-month internet leasing money. Use the possessions appraiser’s thoughts out-of fair business book from all tools, including your own personal. After that deduct twenty-five% or the vacancy grounds provided with the fresh new appraiser, whatever is deeper.

- Know if the home are mind-enough. The brand new PITI split because of the online rental money may be from the very 100 per cent.

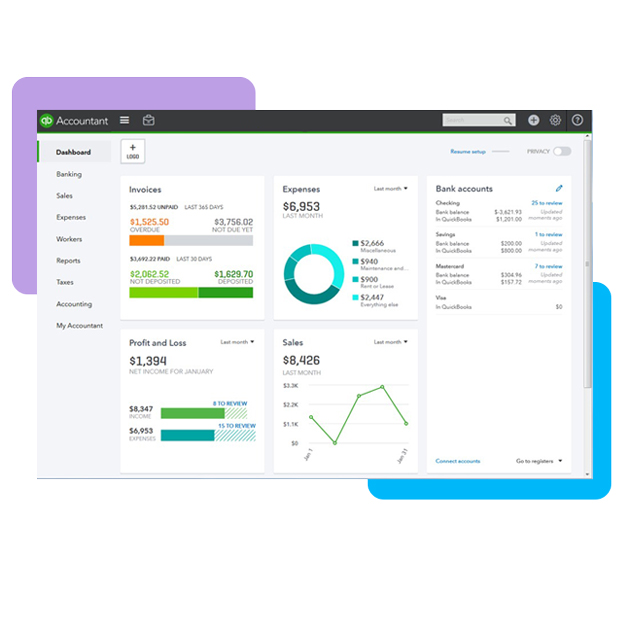

FHA Care about-Sufficiency Calculator

Come across latest FHA pricing, payments, and closing costs. Obtain the information to know what to anticipate when purchasing a great 3-4 product possessions.

In advance of offe band to get a around three- or five-equipment possessions, make your best effort to decide whether the possessions possess an optimistic income. Opting for an experienced financial and you will realtor and seeing them can help you build told conclusion and prevent prospective factors together with your financial app.

First, get a proven home loan pre-approval letter out of a mortgage lender. Confirmed is much more reputable than just unproven pre-approvals regarding larger banking institutions and you may internet loan providers. Like, during the NewCastle Mortgage brokers, an official home loan underwriter exactly who helps to make the last mortgage choice feedback your borrowing from the bank and you can economic information initial. This way, you become pretty sure regarding the to shop for a multi-unit family.

2nd, affect a real estate agent. A consumer’s representative can help you estimate local rental earnings having a beneficial multi-product property by researching similar rents.

In relation to a certain multiple-tool possessions, follow up together with your bank. The financial institution computes the fresh new month-to-month property fee, analyzes the fresh new leasing money possible, and you can assessment new property’s notice-sufficiency.

You can observe newest pricing, costs, and you may settlement costs on our web site 24/7-accessibility advice when it’s needed very for taking advantageous asset of every possibilities.

What are my choice whenever a beneficial 3-4 device possessions goes wrong FHA’s self-sufficiency sample?

Discover a special possessions. If for example the possessions does not see FHA’s conditions which can be not financially viable, consider looking an alternative assets that fits disregard the requirements and you may funding requirements.

Use another type of financing program. Antique mortgage loans do not require a home-sufficiency decide to try. But not, they may require a larger downpayment and you will restriction the newest rental money you can make use of so you’re able to be eligible for the mortgage.

Improve local rental money. Opinion the fresh new appraiser’s viewpoint regarding fair markets lease about assessment statement and compare they for the real estate agent’s research. In case your appraiser missed equivalent rents, ask the financial institution to examine their agent’s markets analysis or help documents. Which have support documents, the lender can focus the newest assessment, improve the internet local rental earnings, and you can approve the loan.

Slow down the PITI . Review the new property’s expenditures to see a way to remove all of them. Like, reduce the amount borrowed, select a cheaper homeowner’s insurance carrier, otherwise reduce the financial rate of interest.