ten Points One to Qualify Your Having A USDA Mortgage loan into the Michigan

Some of the requirements one be considered your to have a good USDA mortgage financing inside Michigan tend to be – earnings, down payment, fico scores, and a lot more. Bringing a great USDA loan isnt much unique of bringing an excellent conventional home loan. Listed here are 10 situations that can effect the loan acceptance.

1munity Bank Acceptance with USDA

USDA is actually a government institution you to sponsors the application, but your community lender often handle 100 % of your deal. It indicates your area banker do everything from getting the job to providing the very last approval. USDA places a read last stamp away from recognition to your mortgage, and even that’s managed because of the bank. Manufacturers can also be lead as much as six per cent of the conversion rates towards closing costs.

2. Zero Down payment

The brand new down-payment requirement – otherwise insufficient you to definitely ‘s the reason a lot of customers purchase the USDA home mortgage program. No deposit required, so it is mostly of the 100 % funding lenders obtainable in today’s sector.

You really have a downpayment virtue that would simply take decades having most families to keep 5 per cent off or maybe more. In those days, home prices can move up, and make rescuing an advance payment even more difficult. Which have USDA mortgage loans, homebuyers can purchase immediately or take advantageous asset of increasing home beliefs. Minimal credit history for USDA acceptance is 640. The new borrower need a relatively good credit record which have limited 30 day late payments during the last 1 year.

cuatro. First-Date Homeowners

USDA guaranteed mortgage loans are not right for most of the consumer. But, any basic-date otherwise recite consumer finding property beyond major urban centers should examine their qualifications into program. The application is present for sale transaction merely, zero investment properties or 2nd belongings. A purchaser do not individual an alternative home during the time of pick.

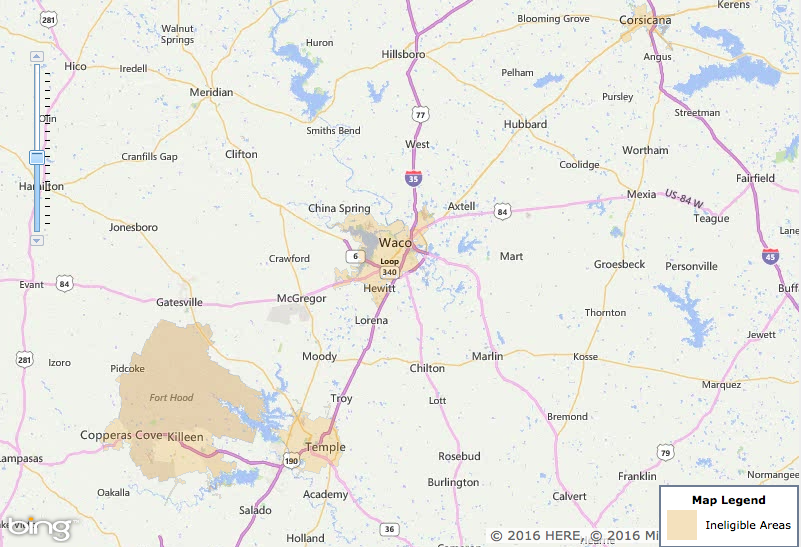

5. Geographic Restrictions

Geographic components for USDA mortgage loans are to own residential property that have to be found in this an effective USDA-eligible area. Becoming qualified, a home have to be inside a rural area. Essentially, places and places having a people less than 20,000 qualify.

6. Appraisal and Possessions Requirments

An appraisal with the possessions to decide its worth required. The new appraisal statement and verifies the home is actually livable, secure, and you will suits USDA’s minimal possessions requirements. Any safeguards or livability facts must be remedied prior to mortgage closure.

eight. House Limitations

USDA mortgages commonly supposed to loans farms otherwise highest acreage attributes. As an alternative, he’s geared toward the standard unmarried-home. You could money some condominiums and you may townhomes on system.

8. Number 1 Home Standards

Property becoming purchased should be your primary house, definition you intend to live on around to your foreseeable future. Leasing attributes, funding qualities, and you may second house sales aren’t eligible for brand new USDA mortgage loan program.

nine. Loan Size by Money

There are not any stated mortgage limits getting USDA mortgages. As an alternative, an applicant’s earnings establishes the utmost mortgage dimensions. The brand new USDA money restrictions, following, verify sensible loan models on system. Income of the many relatives 18 years of age and you may old dont meet or exceed USDA assistance here.

10. Installment Feasibility

Your generally you prefer a good 24-day reputation of dependable a job so you’re able to be considered, and additionally adequate income away from told you employment. But not, schooling inside a related job can also be replace some otherwise each of you to definitely experience requirement. The bank will determine fees feasibility.

USDA’s mandate should be to promote homeownership within the non-towns. As such, it will make their financing reasonable so you can a wider spectrum of family customers by continuing to keep costs and you may charge reasonable.

Learn more about the key benefits of a USDA home loan and working with nearby area financial. Communicate with our home loan experts at Chelsea Condition Lender. Contact our very own workplace because of the mobile: 734-475-4210 or online.