Version of Home loans locate Which have good 650 Credit history

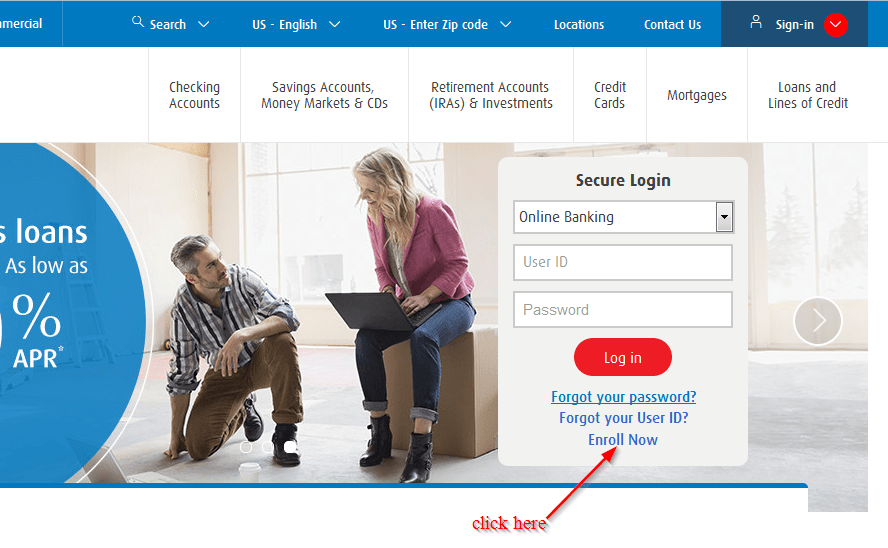

- Score a mortgage loan pre-recognition to have an estimate out of exacltly what the interest and you will costs might possibly be once you intimate.

There are a few different varieties of home loans you might use to possess having an effective 650 credit score, based your financial situation, income, down-payment, or other points.

Quick and easy Home loans which have a beneficial 650 Credit history

If you are searching for ease of software, automation, and you may benefits, on the web financial businesses are your best option. A few of all of them might even provide competitive prices, so you may be able to help save more money versus antique financing. Specific on line lenders together with are experts in a niche, such as earliest-date homebuyers, very often there is things readily available for folk. Score a free of charge credit report on the around three big credit agenciesTransunion, Experian, and you will Equifaxbefore applying to possess pre-acceptance.

Getting pre-acknowledged having an on-line financial might be easily in the event that you happen to be planned. You will have to complete the applying and gives support records, including:

- Tax returns

- W2s, 1099s, and other a job-related earnings statements for the last two years

- A position record for the past step 3+ years

- Month-to-month earnings out of every sources

- Monthly easy cash loans Newton costs

- Total safeguarded and you will unsecured outstanding debts

- Statement if you have had one defaults otherwise foreclosures

The lending company will then offer you a quotation of how much your be eligible for. Preapprovals are generally good for up to two months, so it’s far better submit an application for them if you are about to initiate enjoying residential property.

FHA Fund

FHA fund are thought is less risky by the loan providers because the he or she is covered, it is therefore better to qualify for all of them. Needed a credit score of at least 580 for people who need to qualify for that loan on the Federal Homes Government having a down payment of 3.5%. If you are happy to generate an advance payment away from ten% or higher, there is absolutely no lowest credit rating requisite, however, lenders may have their criteria that you’ll need certainly to see to help you qualify.

Something to keep in mind is the fact with FHA fund, you’ll need to pay mortgage insurance rates for your time of the mortgage. You will need to pay the insurance rates fee within closure and you may pay this new monthly insurance payments, that could make the mortgage a tiny costly sometimes.

Mortgage insurance is a policy one protects lenders facing loss you to result from non-payments into the mortgage loans. This insurance rates mainly covers lenders from loss of a prospective decrease from the value of the true property you to obtains the loan loan. FHA mortgages do not require Individual Home loan Insurance policies (PMI), but since they require like a reduced down-payment, brand new FHA means one another upfront and annual mortgage insurance rates for everyone consumers, no matter what level of down-payment you make on start of mortgage.

For every single loan offer differs, but when you has actually an FHA mortgage identity of more than 15 years, you’ve been investing they for around 5 years, and then have an LTV proportion out-of 78% or smaller, that it financial insurance rates is easy to remove regarding loan. Brad Reichert

Home loans to own Very first-Time Homebuyers

While you are to invest in a house the very first time, you can find software which can help you help make your dream away from home ownership a reality. These software can help you get a good home loan rates or qualify for a lower life expectancy deposit. Interest levels have increased considerably within the last while, and you will houses rates are still highest, very such software can be the lifeline you to definitely very first-date buyers may prefer to hold the key to the basic house.